If you were convicted of a drug possession or distribution offense while receiving federal financial aid you need to complete a drug rehabilitation program and pass two drug tests for your application to be considered. Those convicted of possessing or selling drugs after submitting FAFSA will lose their eligibility and must repay all financial aid received after their conviction.

Educational Pell Grants For Felons Step By Step Guide On Applying For A Pell Grant Jobs That Hire Felons

Educational Pell Grants For Felons Step By Step Guide On Applying For A Pell Grant Jobs That Hire Felons

However there are some restrictions that apply.

Can convicted felons get financial aid. Student Financial Aid If you have been convicted of any offense misdemeanor or felony involving possession or sale of drugs then you are to receive federal student aid including grants loans or work assistance for a specified period of time. To the guy who. As long as a past felony was not related to drugs a convicted felon is eligible to apply for loans and financial aid like any other college student Requirements Those looking for financial aid.

It could also make it difficult to obtain funding for higher education. Two types of convictions can affect eligibility. I was paying for my education with financial aid.

From the FAFSA free application for federal student aid website wwwfafsaedgov. Youll find a link in the Resources box below. Below you will find many different pages regarding loans grants and scholarship.

To get financial aid fill out the Free Application for Federal Student Aid FAFSA. Yes having a criminal conviction on your record will make getting financial help for your education more difficult. Felons can receive student aid grants depending on what their offense was.

A financial aid officer can help determine which scholarships require this form. There is various of help for convicted felons in Texas to proceed preparation. I was convicted of a felony in 2005 at the age of 19 while I was in college.

The FAFSA helps determine if you can get financial aid. Yes you can qualify for the food stamp program with a felony offense on your record. Our organization Help For Felons is also going to be launching our own scholarship within the next couple of months so.

Financial Help For Felons - Help For Felons. The grants do not have to be paid back. Many people with felony convictions can receive financial aid but dont apply because they think they wont qualify.

Felons that were convicted for possession or sale of illegal drugs while receiving federal student aid cannot receive federal aid unless they complete an approved drug rehabilitation program. Government grants for convicted felons are also available to complete your education and fix your life. They miss their chance to go to college based on wrong information.

If you do not disclose the information and they do find out you will be forced to pay back all the financial aid as well as the fines and fees which are enormous. While all of that sounds great can you get food stamps with a felony conviction. Financial Help For Felons Help For Felons Admin 2018-04-04T1535360000.

However your sentence should not relate to a drug-offense. Federal Student Aid Felons who would like to enroll in a trade program or go to college may be able to receive a grant from the federal government to cover the costs of the program. Yes unless it was a felony drug conviction while the student was receiving federal financial aid.

Many people with felony convictions can receive financial aid but they dont apply. With a couple of exceptions convicted felons have access to the same college aid as any other United States citizen. To continue your education you can get some financial grants and assistance.

Unfortunately yes they can keep you from getting financial aid for drug charges. If you have a drug-related conviction you may not be eligible for food stamps. Grants and loans are available.

With any other type of felony you will probably qualify. A second conviction earns them two years of. Under the current rules if a student is convicted of drug possession they face one year of ineligibility from the time of their first conviction.

Being convicted of a felony or misdemeanor offense can have serious consequences that could affect your eligibility to receive federal grants loans or work-study. Drug convictions and sex. The best way to find out what aid you qualify for is by completing the FAFSA.

Of course keep in mind eligibility for federal grants and loans require that you qualify financially. With any other misdemeanors or felonies you are in fact eligible for the federal financial aid program in total. Here are the directions to get financial aid for your education.

Federal Student Aid. I was told since I now had a felony I would not be able get approved for financial aid again until my record was expunged or pardoned. The short answer is.

With Penn Fosters interest-free payment. The Department of Educations Federal Student Aid website provides a free online guide that walks students through the financial aid process.

Penn Foster High School Transcript Example Page 4 Line 17qq Com

Penn Foster High School Transcript Example Page 4 Line 17qq Com

Penns grant-based undergraduate financial aid program meets 100 of demonstrated financial need with grants and work-study funding making it possible for students to graduate with a world-class undergraduate.

Penn foster financial aid. 6 They can also use it to search for legitimate scholarships on the site and learn about the different types of loans. Does Penn Foster College have any kind of financial aid programs. That said with the dental assisting program you should have checked with your state board to confirm it would accept the course from PF.

A Penn Foster tuition assistance. We want to make sure that the costs associated with going back to school dont get in the way. The Penn Foster financial aid assistants a work with the student to come up with a workable tuition plan.

While federal student loans and traditional financial aid such as FASFA are not accepted at Penn Foster they do offer other forms of financial assistance to help students pay for their education. Dont let tuition stand in the way of your. Asked by Wiki User.

Chat online or call 1-800-275-4410 to speak with a Penn Foster admissions specialist. As we have mentioned before Penn Foster College is an affordable place to learn. Looking for an affordable way to get a quality education.

Does Penn Foster accept financial aid. Penn foster financial aid. Penn Foster is a nationally accredited program.

Thats why Penn Foster now offers the benefit of financial assistance to help make the cost of your education more affordable for you. No they dont do any federal financial aid. Customized payment plans That work for you and your budget.

If you think you may be eligible check with your local or regional VA office. Approved for veterans education benefits Many Penn Foster programs are approved for veterans education benefits. At Penn Foster we believe that everyone who wants to advance their education should have an opportunity to do so.

There is always 0 interest. They offer associates and bachelors degrees. The Penn Foster Financial Assistance Plan.

We make it easy to get started. Choose from our low-cost programs and Penn Foster will create a tuition plan that works for you your budget and your lifestyle. The pilot programs stem from a multi-year collaboration among more than 30 child-welfare agencies independent-living and school-readiness programs financial-aid agencies and governmental and non-profit organizations across Pennsylvania to develop best practices for recruiting retaining and support for students transitioning to college from foster care.

Penn Foster offers low tuition with 0 interest and affordable monthly payments so students graduate without debt. Penn foster financial aid ïCanine Training The Dog Whisperer Way Dog owners all over the world have found great success with methods from well-known coach Cesar Millan. 0 Interest With all books and learning aids included in your tuition.

Penn Foster does not accept federal financial aid. Reservists may also qualify for veterans education benefits. All Penn Foster programs are.

Though no financial aid is accepted we offer affordable monthly payment options with 0 interest. They consider everything from your budget based on current and planned income to the lifestyle you intend to live. If you wish to receive credit contact the college you attended and request for your official transcript s to be sent to Penn Foster College for evaluation.

Whether in the form of student loans or grants such as the Pell Grant available through FAFSA we are unable to accept the same forms of aid as many major universities. 5 FinAid is another good website that offers students free financial aid information. This is reflected in their degree and associate program cost per credit hour which are in the range of 69 to 85 based on the course.

Wiki User Answered 2012-05-28 095632. Looking at your budget from an honest perspective can help you to stay out of debt. SAVE up to 20 Click here to select your program.

Whether people are looking to teach young puppies the proper way or appropriate issues with their challenging canines Cesars canine training offers a managed systematic approach that canines. Penn Foster Career School is licensed by the Pennsylvania State Board of Private Licensed Schools. You must have a minimum grade of C and up to 75 of required credits may be transferred.

Penns commitment to access and affordability is an integral component of the Penn Compact 2020 and much of that mission is accomplished through the Universitys financial aid programs. The longtime affordable education institution has zero percent interest monthly payment plans. Founded in the year 1890 by the news editor Thomas J.

All approved transfer credits will be deducted from your tuition. I am currently taking their business management program and let me tell you it is no picnic. From the year it was established Penn Foster College has been dedicated to fostering knowledge skills and credentials that can help them work toward their goals of advancing in their chosen field starting a new career or pursuing lifelong learning.

Foster keeping in mind the advancement of careers and education of the coal miners this institute has.

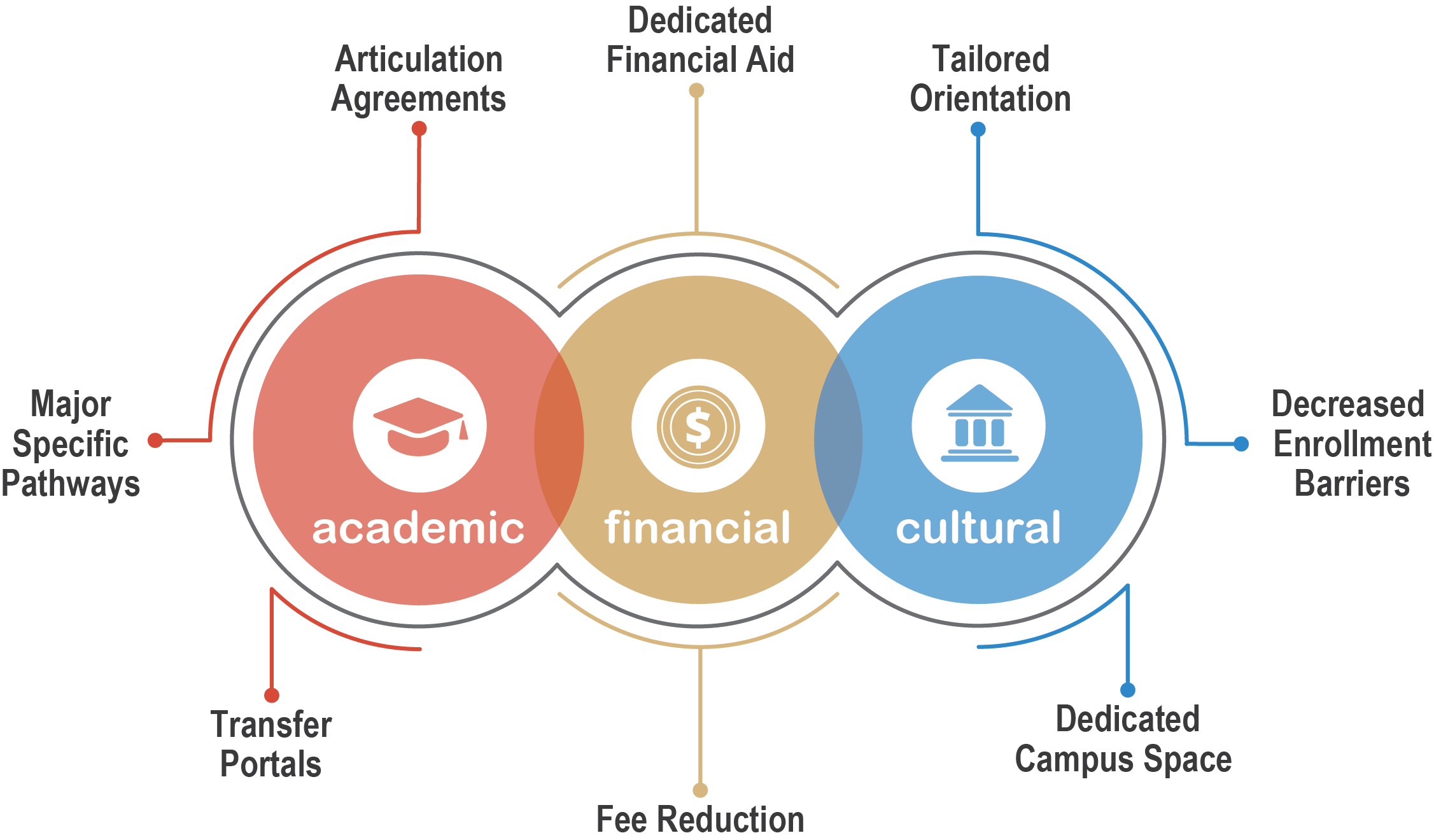

Also at many schools transfer applications are accepted much later than the applications for new first-year students. Based on student budgets calculated by financial aid offices students can save as much as 30000 or more by attending a community college instead of a private 4-year college.

Each school is responsible for making aid decisions independently and there can be a pretty big difference from one school to another.

Can you transfer financial aid to community college. Unlike freshmen moving to sophomore year at the same college transfers need to understand that financial aid they received from their prior institution does not carry over in any way to the next college or university. Federal Student Aid. Any aid given directly by your original school will not continue as you transfer.

If you were receiving any state or institutional aid at your old school do not count on receiving these at your new school. Students who start out at a community college will save a significant amount money on tuition and room and board costs. Transfer students also need to update their FAFSA with information from their prior institution.

Yes - unfortunately you will need to reapply to the new college. Just knowing that credits from the second college transfer to your home school isnt enough. Transferring FAFSA to Another School Transferring financial aid from one school to another needs to be at the.

If youre lucky enough to be attending a four-year college that has an articulation agreement with the local community college that makes your process a whole lot easier. The financial aid application process simply starts anew. Transferring schools can affect your student loans and overall financial aid package whether you are planning to transfer at the end of the fall semester or at the end of the school year.

If youre transferring to a community college then youre most likely looking at Stafford Loans andor Perkins if. If youre hoping that the financial aid will transfer along with you dont hold your breath. Youll now need to resubmit the FAFSA with the new institutions information.

When you decide to transfer from a community college to a four-year school you cant expect to just transfer all your aid with you. Transfer students who live on-campus will find strong community in their undergraduate Houses. Your financial aid award will.

They can provide an affordable way to begin college then you can often transfer your earned credits to a four-year school if you want to pursue a bachelors degree. Financial aid for junior and community college students can come in handy for those young people who are most likely to benefit from attending a year. The best merit scholarships tend to go to incoming first-year students.

Its not uncommon for transfer students to find that they are low on the priority list when colleges allocate financial aid. Your FAFSA record is linked to your current institution so if you want to transfer to another school you will need to transfer financial aid too. When you applied to the school you likely filed a FAFSA and had them calculate your financial need.

You may have already submitted a Free Application for Federal Student Aid FAFSA for community college over the past two years. Deadline for all transfer application and financial aid materials. But transferring colleges isnt always a smooth process and could end up costing you more than you expect.

The Transfer Admissions Committee begins to review applications after the application deadline. Submitting your materials early does not increase your chances of. Your original school took that need into consideration when creating your offer letter to see how much aid they would give you.

The good news is you can apply for a new student financial aid package at your new school. If you receive your FAFSA student financial aid from your current school you probably wont be able to get your aid back unless you improve your academic progress. Some four-year schools will transfer your credits but not your grades from community colleges.

Thankfully entering the school code on the FAFSA is all you have to do for those as well. This means transferred credits wont improve your overall or in-major GPA. The federal government offers other grants and loans that you will have to transfer to your new school.

This entails nothing more than adding. Your Pell Grant is likely not the only type of financial aid that you will have to think about when you change schools. The only major difference is that junior colleges are typically private schools.

Some schools offer transfer scholarships particularly for community college students. Financial aid however tends to get awarded until funds dry up. In many cases yes.

Other resources for community college graduates transferring to four-year schools include scholarship programs from private organizations such as Pearson the Jack Kent Cooke Foundation and Phi Theta Kappa. Community college cost savings. We will notify applicants of admissions decisions by mid-May.

Articulation agreements ensure that your credits will transfer over and count towards your degree.

Federal Pell GrantThe Federal Pell Grant is available to US. Students can also access student loans and other types of federal student aid.

Pell Grant Payouts Not Keeping Up With College Costs College Financing Group

The awarded amount is based on financial need enrollment status and program costs.

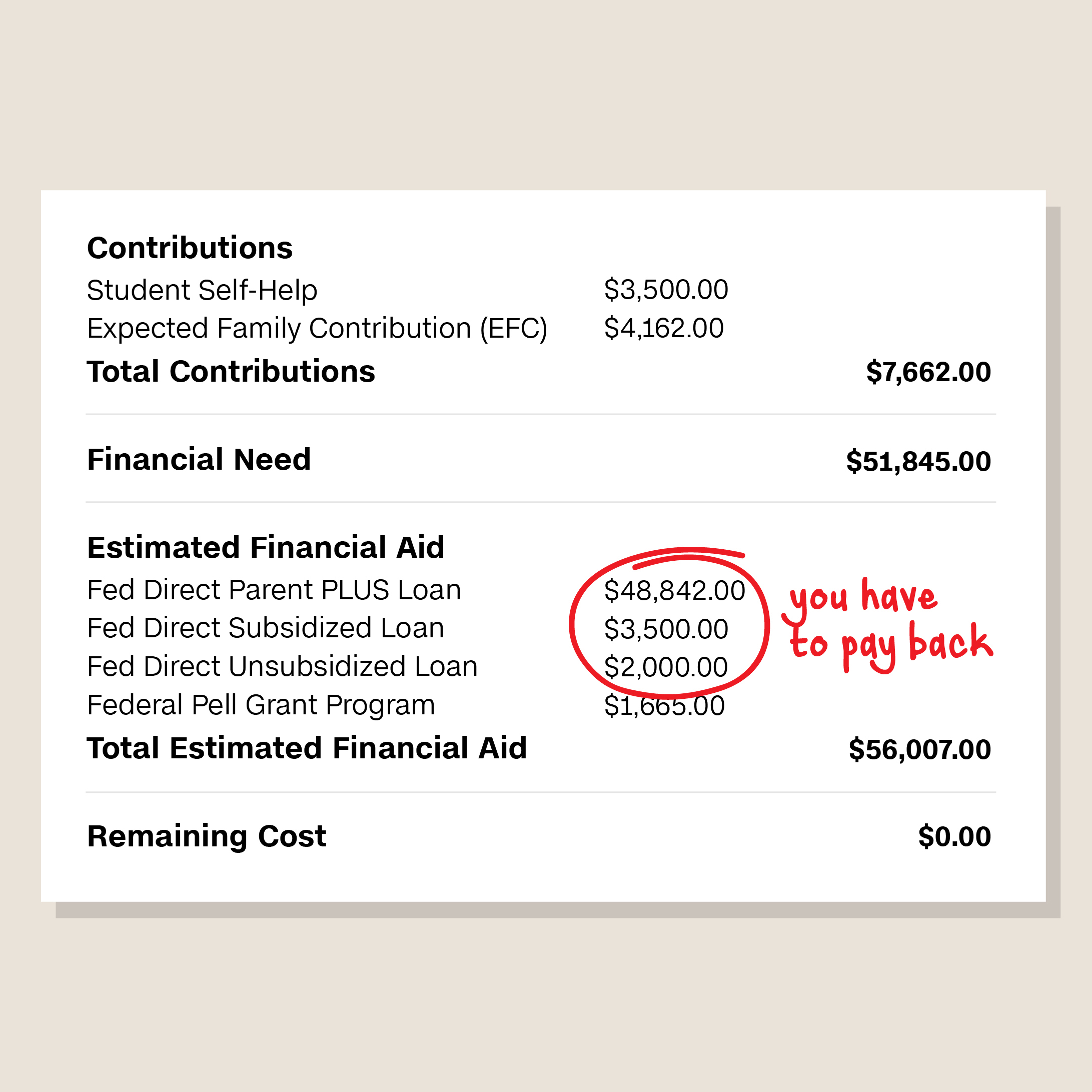

Pell grant vs financial aid. A Pell Grant is free mone. This includes Pell Grants which provide free funds for students with a financial need. To determine financial need your familys income and expenses are measured up against what it will cost for you to go to school.

Congress to be the foundation of financial aid Pell Grants are the primary type of federal grant. Designed by the US. Citizens or eligible non-citizens who demonstrate exceptional financial need.

Federal Pell Grants are considered a foundation of federal financial aid to which aid from other federal and nonfederal sources might be added. The maximum can change each award year and depends on program funding. She believes that once her child has reached the age of 18 he is on his own.

During the 2018-2019 school year for example the federal government gave out. The student didnt begin taking all classes before the financial aid lock date. While there isnt a separate application required eligibility is determined by several factors including.

Federal Student Aid. Both are for students with financial need. Some Cal Grants have a minimum GPA requirement while federal Pell Grants do not.

Eligible students may receive up to three Pell awards in one academic year. One of the primary products that guidance counselors and college financial aid officers rely on to obtain funding for students in need is the Federal Pell Grant. To apply for a Pell Grant you must submit the FAFSA.

One full-time semester of Pell equals 50. The maximum timeframe that students may receive Federal Pell Grant is the equivalent of twelve full-time semesters or 6 years. Federal Pell Grants usually are awarded only to undergraduate students who display exceptional financial need and have not earned a bachelors graduate or professional degree.

First up see if you can get federal financial aid for trade schools. A Pell Grant is free mone. You could qualify for both a Pell Grant and a Cal Grant.

This is not a loan does not need to be repaid in any way and is usually referred to as the foundation of federal student financial aid because it is the first step in obtaining additional funds from other sources. For more information about the Federal Pell Grant visit the Department of. The maximum first Scheduled Pell Grant award for the 2020-2021 award year is 6345.

This video discusses what a Federal Pell Grant is in the financial aid process for colleges and universities in the United States. Although this may be true for many things when it comes to. Pell Grant awards are based on financial need and usually go to students with an annual family income below 40000 though technically theres no income threshold for eligibility.

Pell Grants are federal grants and Cal Grants are state grants. Pell Grant alone is not enough to cover the full cost of attending classes in the summer. Although Lauras main concern is Pell Grant funding shes making an all too common mistake when it comes to federal financial aid.

Pell Grants are pro-rated for students taking class part-time. Pell Grants are a form of federal financial aid offered through the US. As long as you remain eligible you will not need to pay these funds back.

The amount of aid you can receive depends on your financial need the cost of attendance at your school and more. The maximum Pell Grant award for 2015-16 is 5775To apply students must submit the FAFSA application and complete Cornells Financial Aid application process. Post April 26 2018.

Department of Education DOE for students with financial need. The information provided on your FAFSA You and your familys EFC. A federal Pell Grant is financial aid in the form of gift money that is offered to undergraduate students with financial need.

Still Pell Grants are an important financial aid to help students bridge the college cost gap. A Pell Grant is federal aid thats awarded to undergraduate students who demonstrate financial need. Financial aid doesnt cover classes not enrolled instarted before the lock date.

Federal Pell Grant funds can be used to pay for your tuition and school fees. As such additional federal grants are often attainable only after a student receives a Pell Grant.

Halaman

Severnvale Academy

Cari Blog Ini

Arsip Blog

Arsip Blog

- July 202126

- June 202123

- May 202126

- April 202132

- March 202129

- February 202124

- January 202126

- December 202026

- November 202026

- October 202020

- September 202023

- August 202026

- July 202032

- June 202026

- May 202022

- April 202017

- March 202041

- February 202033

- January 202022

- December 201921

- November 201914

- October 201927

- September 201923

- August 201924

- July 201920

- June 201924

- May 201926

Label

- 1930s

- 1940s

- 1950s

- 2019

- 2023

- abac

- abilities

- about

- absolutism

- abstract

- academic

- accelerated

- accent

- accept

- acceptance

- access

- according

- account

- accreditation

- accredited

- achievement

- actions

- active

- activities

- address

- adjective

- adjectives

- admission

- admissions

- adults

- advanced

- advantages

- affect

- africa

- african

- after

- agent

- agreement

- alabama

- alarm

- alcohol

- algebra

- allowed

- alpha

- america

- american

- americans

- analogy

- analyses

- analysis

- ancient

- animal

- anime

- another

- answer

- answers

- anthropology

- apostles

- apostrophe

- appear

- application

- applied

- appraiser

- approach

- aptitude

- argumentative

- army

- arrival

- article

- articles

- arts

- ashworth

- assessment

- assistant

- associates

- asterisk

- astrick

- asvab

- athlete

- audio

- automotive

- average

- awareness

- bachelor

- back

- bank

- banking

- banks

- base

- based

- become

- beginners

- behaviorism

- being

- bella

- benefits

- best

- between

- bible

- bill

- biology

- birthday

- board

- book

- boys

- bridge

- bring

- broadcasting

- brochures

- bronx

- building

- burlap

- cabriolet

- calculate

- calculating

- calculus

- california

- called

- campbells

- canada

- capitalist

- card

- caribbean

- carribean

- cartoon

- cases

- catalog

- catapults

- catcher

- cause

- caused

- central

- certification

- certified

- change

- chapter

- characteristics

- charge

- check

- checkbook

- checks

- cheerleading

- chemistry

- cherokee

- child

- children

- chinese

- chiropractic

- choice

- christ

- christianity

- christmas

- citizenship

- city

- civil

- class

- classes

- classrooms

- clause

- clothes

- clothing

- college

- colleges

- collegiate

- color

- colors

- columbus

- communication

- community

- como

- compliance

- composite

- compound

- comprehension

- concept

- concepts

- conclusion

- cons

- consequences

- content

- contextual

- continuing

- controversy

- converter

- convicted

- cool

- copy

- cords

- corps

- cost

- council

- courses

- court

- cover

- creative

- credential

- credit

- credits

- criminal

- criteria

- cross

- culinary

- cultural

- cumulative

- cursive

- curves

- cycle

- dates

- debate

- decline

- definition

- deforestation

- degree

- degrees

- delivery

- delta

- dependent

- describe

- design

- designing

- detroit

- devices

- dibels

- diciples

- diction

- difference

- differences

- different

- digital

- diploma

- disciples

- discipline

- disturbance

- diversity

- doctor

- doctoral

- doctorate

- does

- double

- dream

- drugs

- duty

- each

- easiest

- easy

- ecological

- economics

- economy

- edit

- education

- educational

- effect

- effects

- egypt

- ehow

- election

- elementary

- elements

- emotional

- ending

- engineering

- english

- enterprise

- equine

- essay

- essays

- esta

- estas

- ethical

- ethics

- european

- exam

- example

- examples

- excel

- excelsior

- exercises

- experience

- experiments

- explain

- extemporaneous

- facs

- factors

- facts

- fafsa

- fail

- fair

- fake

- fashion

- feather

- federal

- fees

- figure

- filing

- fill

- final

- financial

- find

- first

- five

- flag

- florentine

- florida

- fluency

- football

- foreign

- forensic

- formal

- format

- forward

- foster

- four

- framework

- free

- freshman

- freshmen

- friend

- friendly

- from

- full

- funny

- gaelic

- games

- general

- genre

- george

- gesell

- getting

- gifts

- gilligan

- goals

- going

- good

- goodbye

- goodnight

- goose

- government

- gowns

- grade

- grader

- grades

- graduate

- graduation

- grant

- great

- greek

- green

- gunpowder

- guns

- handbook

- handwriting

- happens

- happy

- harvard

- have

- hbcu

- hebrew

- hello

- hematologist

- hexagon

- hierarchy

- history

- holes

- homecoming

- homes

- homeschooling

- homework

- honorary

- honors

- hopkins

- hour

- hours

- housing

- however

- human

- humanities

- hunter

- hunting

- icebreakers

- ideas

- identifier

- identify

- idiom

- impact

- implications

- important

- inaugural

- income

- index

- indian

- inference

- Information

- informative

- intent

- international

- into

- introducing

- invented

- invention

- investment

- invocation

- ireland

- irish

- iroquois

- island

- italian

- jacket

- japanese

- jefferson

- jesuit

- jesus

- johns

- jointly

- joyner

- justice

- juxtapose

- juxtaposes

- kaplan

- kappa

- kentucky

- khan

- kids

- kindergarten

- king

- know

- known

- kohlberg

- lady

- language

- languages

- large

- largest

- league

- learning

- leed

- length

- lengthen

- lenni

- lesson

- letter

- letterman

- letters

- level

- levels

- liberty

- library

- license

- life

- limitations

- line

- list

- listening

- literature

- live

- location

- long

- longer

- look

- lost

- louis

- lowest

- lsat

- lsdas

- lyrics

- made

- major

- make

- management

- managerial

- managing

- many

- mascot

- maslows

- masters

- mayflower

- mayor

- mean

- meaning

- meanings

- means

- medical

- medicine

- member

- meridian

- merry

- messenger

- method

- methods

- mexican

- michigan

- middle

- migrant

- military

- miller

- minor

- minute

- minutes

- missing

- mock

- modernism

- modernist

- mohawk

- money

- monitor

- motor

- much

- multivariate

- music

- names

- national

- native

- navy

- nclex

- need

- needed

- negatives

- neonatal

- netflix

- neurologist

- neuroscience

- neurosurgeon

- night

- nike

- nominative

- norm

- normans

- notes

- nouns

- nova

- number

- numerals

- nurse

- nursing

- object

- objective

- objectives

- ohio

- online

- opening

- operating

- opinion

- original

- orlando

- orthopedic

- outline

- over

- owls

- pacific

- paper

- paragraph

- parapsychology

- parent

- parents

- part

- parts

- pass

- passive

- patches

- pell

- penn

- percentage

- percentages

- performing

- person

- personal

- pharmacist

- pharmacy

- philosophers

- philosophy

- phoenix

- phonetically

- phonological

- photography

- phrasal

- physical

- physics

- place

- placement

- places

- plagiarism

- plan

- plans

- play

- pledge

- poem

- poetry

- points

- possessive

- post

- postcard

- poster

- pottery

- practice

- precalculus

- predicate

- prefer

- prefixes

- prejudice

- prepaid

- preschoolers

- presentation

- president

- press

- primary

- prison

- private

- probability

- problem

- professor

- professors

- programs

- project

- projects

- promethean

- pronoun

- pronounce

- pronouns

- pronunciation

- proper

- properly

- pros

- prosody

- prosthetics

- psychology

- punctuate

- pure

- qualitative

- quantitative

- question

- questions

- quotation

- quote

- radiology

- raise

- rally

- ranch

- rank

- ranking

- rate

- rates

- rationale

- readers

- reading

- real

- reasons

- referenced

- regents

- regular

- reinforcer

- reinforcers

- reliability

- reliable

- religion

- remember

- rent

- report

- republican

- required

- requirements

- research

- respect

- response

- responsibilities

- resume

- return

- review

- rock

- rocks

- roman

- rush

- russian

- same

- saxon

- saying

- scholarship

- scholarships

- schooling

- schools

- science

- sciences

- score

- scores

- scoring

- scottish

- seal

- seals

- seattle

- second

- secondary

- secretary

- security

- sell

- semester

- senior

- sentence

- sentences

- september

- series

- shoebox

- short

- should

- show

- side

- sign

- similarities

- simple

- skills

- skip

- skit

- soccer

- social

- society

- sociology

- software

- someone

- song

- sonography

- sound

- source

- south

- spanish

- spatial

- speak

- special

- speech

- speeches

- spell

- sports

- stand

- stanford

- start

- starting

- state

- statement

- states

- statistical

- statistics

- status

- steps

- stna

- stole

- story

- strategies

- structure

- student

- students

- study

- style

- subject

- subjects

- submitting

- suffixes

- suject

- summary

- summer

- superscore

- supposed

- surgeons

- surgical

- sword

- syllabication

- syllables

- symbol

- table

- tacky

- take

- tassel

- taxes

- teach

- teacher

- teachers

- teaching

- team

- teams

- tech

- technician

- technology

- tell

- template

- terminology

- terra

- test

- testing

- tests

- texas

- texture

- thank

- that

- theme

- thepredicate

- therapist

- there

- thesis

- they

- things

- third

- ticket

- time

- times

- today

- toddler

- tools

- topic

- topics

- total

- trade

- traditions

- trainer

- training

- transcript

- transfer

- transitions

- translate

- translation

- trial

- tribe

- trip

- troubled

- true

- tuition

- tutoring

- type

- types

- ucla

- uniforms

- universities

- university

- unofficial

- unweighted

- used

- using

- usps

- verb

- versus

- veterans

- vietnam

- view

- virginia

- visual

- voice

- vowel

- wacky

- want

- wants

- wars

- washington

- ways

- weaknesses

- weapons

- wear

- weighted

- weights

- well

- wellesley

- were

- what

- whats

- when

- where

- whether

- will

- with

- withdraw

- without

- woman

- women

- wood

- word

- words

- work

- worker

- workers

- world

- worship

- worth

- write

- writing

- yale

- year

- yearbooks

- years

- your

- yourself

- youth