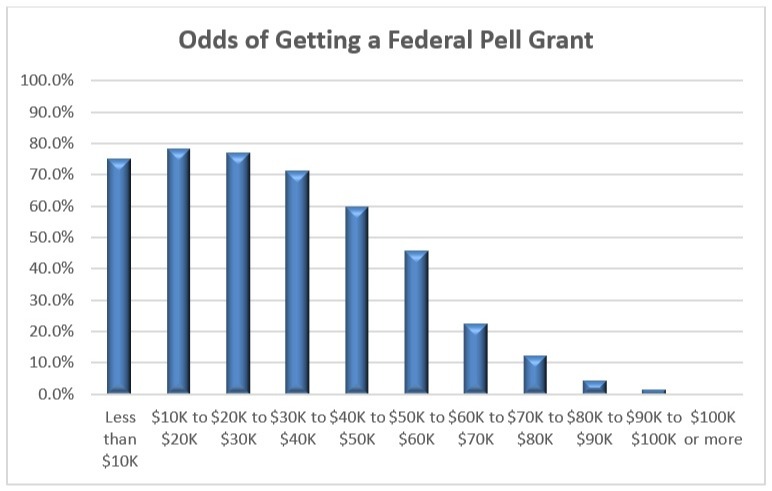

Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC. Even if youre paying 100 of your college expenses living on your own and filing your own taxes youll still need to include your parents info if you dont meet the FAFSA criteria for an independent student.

The Expected Family Contribution Efc For Financial Aid Eligibility Bautis Financial

The Expected Family Contribution Efc For Financial Aid Eligibility Bautis Financial

This does not relate to whether your parents claimed you as a dependent on your taxes.

Fafsa and parents income. More specifically do we have to report the income of a step parent on FAFSA. Everyone regardless of their parents or their income should submit the FAFSA every year. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero.

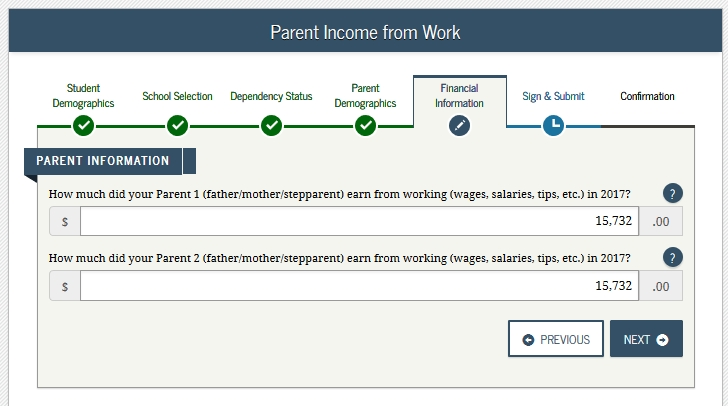

This is most commonly seen in professional programs such as law or medical school. Anyone who has gone through the college application process has heard of the FAFSA. How to Answer FAFSA Question 86-87.

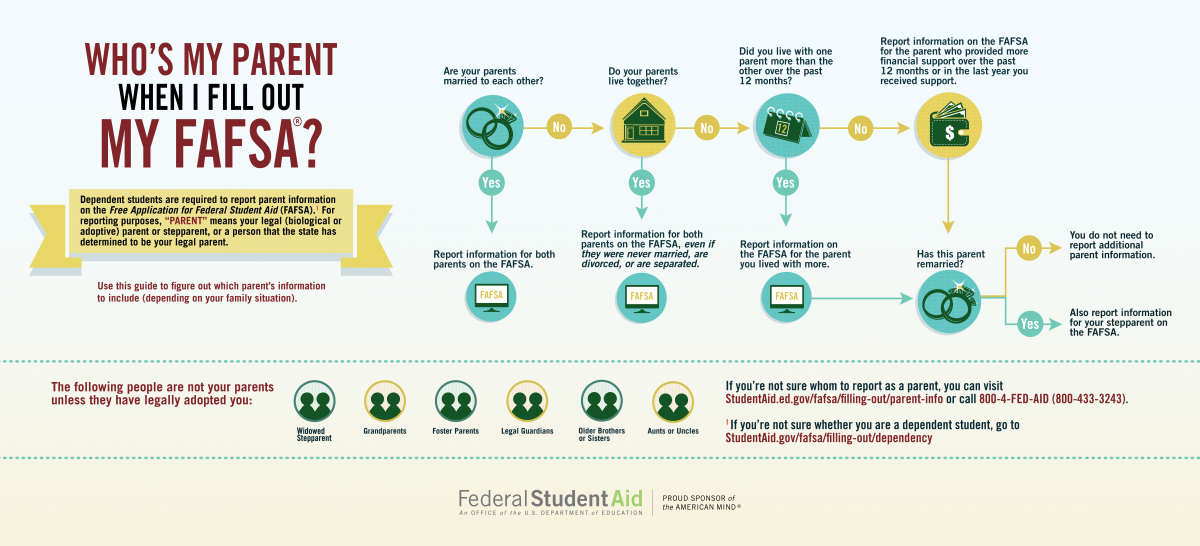

Dealing with the FAFSA to report parent income is the first exposure that many students get to their familys. If a dependent students parents are married and not separated or the parents are unmarried but live together both parents are required to report their income and asset information on the. Which Parents Income Do I Input on the FAFSA Form.

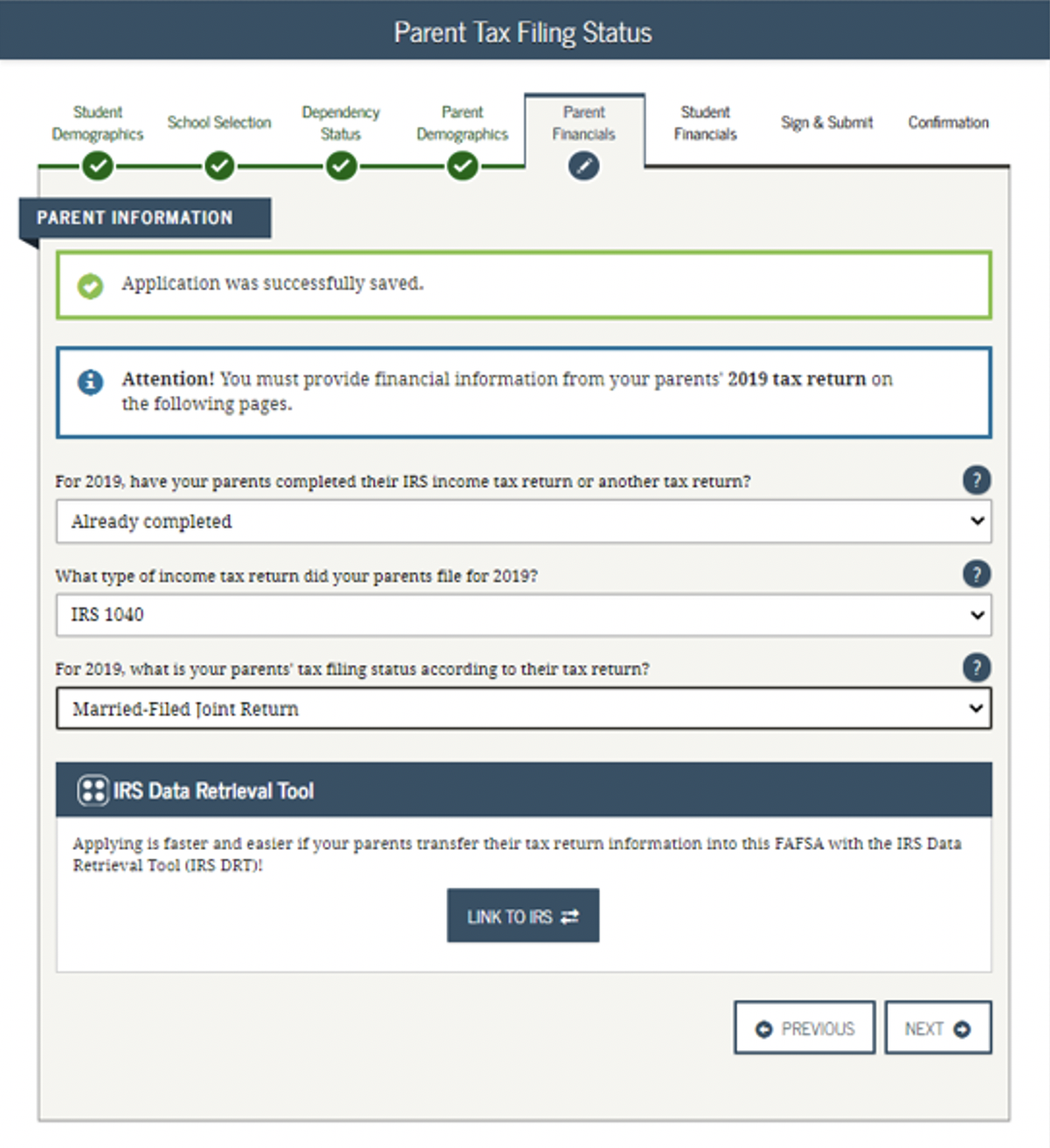

Parent income tends to be overlooked in FAFSA planning which is unfortunate because for most families its the biggest piece and one that has some real planning opportunities. In addition to adjusted gross income from the 2018 tax return the FAFSA asks for a breakdown of each parents earned. The FAFSA rulesguidelines stipulate that the custodial parent which is defined by the parent you have lived with the most over the past 12 months from the date of FAFSA application and back is responsible for filing the FAFSA.

In some cases details about parental income may be requested even if the student is considered independent. Material demonstrating your income and tax statuses this is gathered via tax returns 1040s bank statements and any applicable business records. The FAFSA or Free Application for Federal Student Aid is a form completed by current and prospective college students to determine eligibility for state and federal funding.

If your parent is married and uses the Internal Revenue Service Data Retrieval Tool IRS DRT to transfer information from a joint tax return into your FAFSA form you must manually enter income earned from. For parents and students the FAFSA utilizes the Adjusted Gross Income AGI figure from the relevant tax return as a starting point for income. March 19 2019 One of the biggest myths in the student financial aid world is that you cant submit the FAFSA if your parents have a high income.

Parents Income Information Return To FAFSA Guide Question 86 and 87 ask about earnings wages salaries tips etc in 2019. Typically this is the parent that has provided the most financial support for the child in the. You can also expect less in outright grant money if your parents income is higher.

If youre a dependent student youll report income for both of your legal parents. The FAFSA considers student income in addition to parent income for dependent students or spousal income for married and therefore independent students. Answer the questions whether or not a tax return was filed.

Heres the list of questions to determine your FAFSA dependency status. You do not have to report your parents income on the FAFSA if you are an independent student in the eyes of the federal government. The chart below from the EFC Formula Guide shows the components of parent income.

The FAFSA is based on your parents ability to pay. The FAFSA is as the. Unless the parents earn more than 350000 a year have only one child and that child will enroll at an in-state public college they should still file the FAFSA as there is a good chance they may qualify for federal state or institutional grants.

Fafsa Basics Parent Income The College Financial Lady

Fafsa Basics Parent Income The College Financial Lady

4 Fafsa Tips For Students With Divorced Parents

4 Fafsa Tips For Students With Divorced Parents

2 Major Fafsa Changes You Need To Be Aware Of Ed Gov Blog

2 Major Fafsa Changes You Need To Be Aware Of Ed Gov Blog

Fafsa Basics Parent Income The College Financial Lady

Fafsa Basics Parent Income The College Financial Lady

How Much Did Your Parent Earn From Working In 2019 Federal Student Aid

How Much Did Your Parent Earn From Working In 2019 Federal Student Aid

There S This One Question That I Don T Get While F Chegg Com

There S This One Question That I Don T Get While F Chegg Com

How To Complete The 2021 2022 Fafsa Application

How To Complete The 2021 2022 Fafsa Application

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

How Much Is Too Much Income To Qualify For Financial Aid

How Much Is Too Much Income To Qualify For Financial Aid

11 Common Fafsa Mistakes U S Department Of Education

11 Common Fafsa Mistakes U S Department Of Education

Fafsa Walkthrough Part 6 Parent Financial Information Youtube

Fafsa Walkthrough Part 6 Parent Financial Information Youtube

What Was Your Parents Total Income Tax For 2019 Federal Student Aid

What Was Your Parents Total Income Tax For 2019 Federal Student Aid

How To Fill Out A Fafsa Without A Tax Return H R Block

How To Fill Out A Fafsa Without A Tax Return H R Block

The Parent S Guide To Filling Out The Fafsa Form Ed Gov Blog

The Parent S Guide To Filling Out The Fafsa Form Ed Gov Blog

How To Complete The 2021 2022 Fafsa Application

How To Complete The 2021 2022 Fafsa Application

Cari Blog Ini

Arsip Blog

Arsip Blog

- July 202126

- June 202123

- May 202126

- April 202132

- March 202129

- February 202124

- January 202126

- December 202026

- November 202026

- October 202020

- September 202023

- August 202026

- July 202032

- June 202026

- May 202022

- April 202017

- March 202041

- February 202033

- January 202022

- December 201921

- November 201914

- October 201927

- September 201923

- August 201924

- July 201920

- June 201924

- May 201926

Label

- 1930s

- 1940s

- 1950s

- 2019

- 2023

- abac

- abilities

- about

- absolutism

- abstract

- academic

- accelerated

- accent

- accept

- acceptance

- access

- according

- account

- accreditation

- accredited

- achievement

- actions

- active

- activities

- address

- adjective

- adjectives

- admission

- admissions

- adults

- advanced

- advantages

- affect

- africa

- african

- after

- agent

- agreement

- alabama

- alarm

- alcohol

- algebra

- allowed

- alpha

- america

- american

- americans

- analogy

- analyses

- analysis

- ancient

- animal

- anime

- another

- answer

- answers

- anthropology

- apostles

- apostrophe

- appear

- application

- applied

- appraiser

- approach

- aptitude

- argumentative

- army

- arrival

- article

- articles

- arts

- ashworth

- assessment

- assistant

- associates

- asterisk

- astrick

- asvab

- athlete

- audio

- automotive

- average

- awareness

- bachelor

- back

- bank

- banking

- banks

- base

- based

- become

- beginners

- behaviorism

- being

- bella

- benefits

- best

- between

- bible

- bill

- biology

- birthday

- board

- book

- boys

- bridge

- bring

- broadcasting

- brochures

- bronx

- building

- burlap

- cabriolet

- calculate

- calculating

- calculus

- california

- called

- campbells

- canada

- capitalist

- card

- caribbean

- carribean

- cartoon

- cases

- catalog

- catapults

- catcher

- cause

- caused

- central

- certification

- certified

- change

- chapter

- characteristics

- charge

- check

- checkbook

- checks

- cheerleading

- chemistry

- cherokee

- child

- children

- chinese

- chiropractic

- choice

- christ

- christianity

- christmas

- citizenship

- city

- civil

- class

- classes

- classrooms

- clause

- clothes

- clothing

- college

- colleges

- collegiate

- color

- colors

- columbus

- communication

- community

- como

- compliance

- composite

- compound

- comprehension

- concept

- concepts

- conclusion

- cons

- consequences

- content

- contextual

- continuing

- controversy

- converter

- convicted

- cool

- copy

- cords

- corps

- cost

- council

- courses

- court

- cover

- creative

- credential

- credit

- credits

- criminal

- criteria

- cross

- culinary

- cultural

- cumulative

- cursive

- curves

- cycle

- dates

- debate

- decline

- definition

- deforestation

- degree

- degrees

- delivery

- delta

- dependent

- describe

- design

- designing

- detroit

- devices

- dibels

- diciples

- diction

- difference

- differences

- different

- digital

- diploma

- disciples

- discipline

- disturbance

- diversity

- doctor

- doctoral

- doctorate

- does

- double

- dream

- drugs

- duty

- each

- easiest

- easy

- ecological

- economics

- economy

- edit

- education

- educational

- effect

- effects

- egypt

- ehow

- election

- elementary

- elements

- emotional

- ending

- engineering

- english

- enterprise

- equine

- essay

- essays

- esta

- estas

- ethical

- ethics

- european

- exam

- example

- examples

- excel

- excelsior

- exercises

- experience

- experiments

- explain

- extemporaneous

- facs

- factors

- facts

- fafsa

- fail

- fair

- fake

- fashion

- feather

- federal

- fees

- figure

- filing

- fill

- final

- financial

- find

- first

- five

- flag

- florentine

- florida

- fluency

- football

- foreign

- forensic

- formal

- format

- forward

- foster

- four

- framework

- free

- freshman

- freshmen

- friend

- friendly

- from

- full

- funny

- gaelic

- games

- general

- genre

- george

- gesell

- getting

- gifts

- gilligan

- goals

- going

- good

- goodbye

- goodnight

- goose

- government

- gowns

- grade

- grader

- grades

- graduate

- graduation

- grant

- great

- greek

- green

- gunpowder

- guns

- handbook

- handwriting

- happens

- happy

- harvard

- have

- hbcu

- hebrew

- hello

- hematologist

- hexagon

- hierarchy

- history

- holes

- homecoming

- homes

- homeschooling

- homework

- honorary

- honors

- hopkins

- hour

- hours

- housing

- however

- human

- humanities

- hunter

- hunting

- icebreakers

- ideas

- identifier

- identify

- idiom

- impact

- implications

- important

- inaugural

- income

- index

- indian

- inference

- Information

- informative

- intent

- international

- into

- introducing

- invented

- invention

- investment

- invocation

- ireland

- irish

- iroquois

- island

- italian

- jacket

- japanese

- jefferson

- jesuit

- jesus

- johns

- jointly

- joyner

- justice

- juxtapose

- juxtaposes

- kaplan

- kappa

- kentucky

- khan

- kids

- kindergarten

- king

- know

- known

- kohlberg

- lady

- language

- languages

- large

- largest

- league

- learning

- leed

- length

- lengthen

- lenni

- lesson

- letter

- letterman

- letters

- level

- levels

- liberty

- library

- license

- life

- limitations

- line

- list

- listening

- literature

- live

- location

- long

- longer

- look

- lost

- louis

- lowest

- lsat

- lsdas

- lyrics

- made

- major

- make

- management

- managerial

- managing

- many

- mascot

- maslows

- masters

- mayflower

- mayor

- mean

- meaning

- meanings

- means

- medical

- medicine

- member

- meridian

- merry

- messenger

- method

- methods

- mexican

- michigan

- middle

- migrant

- military

- miller

- minor

- minute

- minutes

- missing

- mock

- modernism

- modernist

- mohawk

- money

- monitor

- motor

- much

- multivariate

- music

- names

- national

- native

- navy

- nclex

- need

- needed

- negatives

- neonatal

- netflix

- neurologist

- neuroscience

- neurosurgeon

- night

- nike

- nominative

- norm

- normans

- notes

- nouns

- nova

- number

- numerals

- nurse

- nursing

- object

- objective

- objectives

- ohio

- online

- opening

- operating

- opinion

- original

- orlando

- orthopedic

- outline

- over

- owls

- pacific

- paper

- paragraph

- parapsychology

- parent

- parents

- part

- parts

- pass

- passive

- patches

- pell

- penn

- percentage

- percentages

- performing

- person

- personal

- pharmacist

- pharmacy

- philosophers

- philosophy

- phoenix

- phonetically

- phonological

- photography

- phrasal

- physical

- physics

- place

- placement

- places

- plagiarism

- plan

- plans

- play

- pledge

- poem

- poetry

- points

- possessive

- post

- postcard

- poster

- pottery

- practice

- precalculus

- predicate

- prefer

- prefixes

- prejudice

- prepaid

- preschoolers

- presentation

- president

- press

- primary

- prison

- private

- probability

- problem

- professor

- professors

- programs

- project

- projects

- promethean

- pronoun

- pronounce

- pronouns

- pronunciation

- proper

- properly

- pros

- prosody

- prosthetics

- psychology

- punctuate

- pure

- qualitative

- quantitative

- question

- questions

- quotation

- quote

- radiology

- raise

- rally

- ranch

- rank

- ranking

- rate

- rates

- rationale

- readers

- reading

- real

- reasons

- referenced

- regents

- regular

- reinforcer

- reinforcers

- reliability

- reliable

- religion

- remember

- rent

- report

- republican

- required

- requirements

- research

- respect

- response

- responsibilities

- resume

- return

- review

- rock

- rocks

- roman

- rush

- russian

- same

- saxon

- saying

- scholarship

- scholarships

- schooling

- schools

- science

- sciences

- score

- scores

- scoring

- scottish

- seal

- seals

- seattle

- second

- secondary

- secretary

- security

- sell

- semester

- senior

- sentence

- sentences

- september

- series

- shoebox

- short

- should

- show

- side

- sign

- similarities

- simple

- skills

- skip

- skit

- soccer

- social

- society

- sociology

- software

- someone

- song

- sonography

- sound

- source

- south

- spanish

- spatial

- speak

- special

- speech

- speeches

- spell

- sports

- stand

- stanford

- start

- starting

- state

- statement

- states

- statistical

- statistics

- status

- steps

- stna

- stole

- story

- strategies

- structure

- student

- students

- study

- style

- subject

- subjects

- submitting

- suffixes

- suject

- summary

- summer

- superscore

- supposed

- surgeons

- surgical

- sword

- syllabication

- syllables

- symbol

- table

- tacky

- take

- tassel

- taxes

- teach

- teacher

- teachers

- teaching

- team

- teams

- tech

- technician

- technology

- tell

- template

- terminology

- terra

- test

- testing

- tests

- texas

- texture

- thank

- that

- theme

- thepredicate

- therapist

- there

- thesis

- they

- things

- third

- ticket

- time

- times

- today

- toddler

- tools

- topic

- topics

- total

- trade

- traditions

- trainer

- training

- transcript

- transfer

- transitions

- translate

- translation

- trial

- tribe

- trip

- troubled

- true

- tuition

- tutoring

- type

- types

- ucla

- uniforms

- universities

- university

- unofficial

- unweighted

- used

- using

- usps

- verb

- versus

- veterans

- vietnam

- view

- virginia

- visual

- voice

- vowel

- wacky

- want

- wants

- wars

- washington

- ways

- weaknesses

- weapons

- wear

- weighted

- weights

- well

- wellesley

- were

- what

- whats

- when

- where

- whether

- will

- with

- withdraw

- without

- woman

- women

- wood

- word

- words

- work

- worker

- workers

- world

- worship

- worth

- write

- writing

- yale

- year

- yearbooks

- years

- your

- yourself

- youth